Blog

-

PsychedeLinks – April 17, 2024

Emerge’s Hot Take Oregon Governor Signs Bill Criminalizing Drug Possession On Monday, April 1, Gov. Kotek signed HB 4002 which…

-

PsychedeLinks – April 1, 2024

Emerge’s Hot Take Boulder College Planning a Psychedelic Studies Undergraduate Minor With the institution of Colorado’s Natural Medicine Health Act…

-

OLCC Cannabis License Moratorium Extended with Passage of HB 4121; New License Caps Also Implemented

Author: Alex J. Berger, Shareholder; Leticia Maskell, Law Clerk On March 20, Governor Kotek signed HB 4121 into law, which…

-

Emerge Law Group and Plant Medicine Law Group are excited to announce a co-counsel collaboration in Oregon!

Emerge Law Group and Plant Medicine Law Group are excited to announce a co-counsel collaboration in Oregon! Emerge Law Group…

-

Business and Brand Identity: Trademark, Assumed Business Name, and Legal Corporate Name

When starting and operating a business, there are three distinct legal names that can shape a company’s identity: trademark, assumed…

-

PsychedeLinks – March 18, 2024

Emerge’s Hot Take Denver Launches Psychedelic Training for Emergency Responders The Multidisciplinary Association for Psychedelic Studies (MAPS) announced the launch…

-

Hey Oregon Marijuana Licensees: We can set up your OLCC CAMP account for you!

As you may be aware OLCC launched its new online marijuana licensing system – CAMP – today, March 18. To…

-

UPDATE/CORRECTIONS: Are You Ready for March 18, The First Day of CAMP? How to Prepare for Oregon’s New Online Adult Use Cannabis Licensing System

Authors: Alex J. Berger, Shareholder; Leticia Maskell, Law Clerk Update: This just in from OLCC; see updates and corrections to…

-

Employee or Independent Contractor? Understanding the New FLSA Guidelines

Author: Leticia Maskell, Law Clerk The U.S. Department of Labor and Wage and Hour Division has released a new set…

-

Natural Medicine Circle – Session 2: A Postcard from Oregon – Lessons Learned

Emerge Law Group is excited to announce the next FREE live virtual event in our series, “Natural Medicine Circle: Community Conversations…

-

Deep Dive Webinar Series – Session 9: OHA Rules Update + More

Emerge Law Group presents the first 2024 installment of its FREE virtual event series “Deep Dive Into the Oregon Psilocybin…

-

PsychedeLinks – February 16, 2024

Emerge’s Hot Take Lykos Therapeutics Announces FDA Acceptance and Priority Review of New Drug Application for MDMA-Assisted Therapy for PTSD…

-

Ketamine 101

Author: Matt Brockmeier, Of Counsel While much of our work in the Psychedelics Practice Group at Emerge Law Group involves…

-

CannaBeat – February 5, 2024

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

Examining Inconsistencies in CRC’s Extension Request Denials: A Call for Clarity

Author: Natalie Diaz, Attorney In recent times, concerns have surfaced regarding the New Jersey Cannabis Regulatory Commission’s (the “CRC” or…

-

PsychedeLinks – January 26, 2024

Emerge’s Hot Take California Paves Way for Psychedelic Therapy After Failure to Legalize ‘Magic Mushrooms’ Legislators in favor of legalizing…

-

CannaBeat – January 22, 2024

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – January 12, 2024

Emerge’s Hot Take MAPS PBC Closes $100m Series A, Rebrands to Lykos Therapeutics MAPS Public Benefit Corporation (MAPS PBC) is…

-

CannaBeat – January 10, 2024

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

LISTEN: Emerge Law Group on ‘Apartment 113’

Last month, Emerge Law Group’s east coast team sat down with podcaster Rob Sanchez on his show, Apartment 113, to…

-

Emerge Law Group Celebrates Alex Berger’s Promotion to Shareholder

Portland, OR – January 1, 2024 – Emerge Law Group is thrilled to announce the promotion of Alex J. Berger…

-

PsychedeLinks – December 29, 2023

Emerge’s Hot Take California Psychedelics Ballot Measure Could Undermine Marijuana Taxes, State Officials Say The California Legislative Analyst’s Office (LAO)…

-

Compliance with the Corporate Transparency Act

Beginning January 1, 2024, a new federal law known as the Corporate Transparency Act (“CTA”) will take effect. The CTA…

-

CannaBeat – December 27, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

Navigating the Psychedelic Frontier: Emerge Law Group’s Comments on Oregon Health Authority’s Proposed Psilocybin Rule Changes (Part 2)

Part 2 of Emerge Law Group's comments on OHA's proposed psilocybin rule changes.

-

PsychedeLinks – December 15, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

Navigating the Psychedelic Frontier: Emerge Law Group’s Comments on Oregon Health Authority’s Proposed Psilocybin Rule Changes (Part 1)

As the world of psychedelics continues to evolve, so do the regulations governing their use. Recently, the Oregon Health Authority…

-

A New Frontier: Understanding Colorado’s Natural Medicine Laws

Authors: Matt Brockmeier, Of Counsel; Kaci Hohmann, Attorney In a historic development echoing the Centennial state’s landmark 2012 ballot initiative…

-

PsychedeLinks – December 4, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

Emerge Law Group announces FREE virtual event series, “Natural Medicine Circle: Community Conversations About the Colorado Natural Medicine Health Act“

This is the first of a series of in-depth conversations with the community about various legal and business issues involving…

-

CannaBeat – November 21, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – November 10, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – November 6, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – October 27, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – October 23, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – October 13, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

NJ Expands Edibles with Resolutions 2023-143 and 2023-144 (Part 2)

Explore Part 2 of our New Jersey cannabis regulations series, where attorney Natalie Diaz unveils which edibles are restricted under…

-

NJ Expands Edibles with Resolutions 2023-143 and 2023-144 (Part 1)

Discover the latest in New Jersey's cannabis landscape with attorney Natalie Diaz. Dive into Resolutions 2023-143 and 2023-144, unlocking the…

-

CannaBeat – October 9, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

New Rules Affecting Ketamine Telehealth

Author: Matt Brockmeier, Emerge Of Counsel Attorney Under the Ryan Haight Online Pharmacy Consumer Protection Act of 2008 a prescribing…

-

PsychedeLinks – September 29, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – September 27, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

CRC to Begin Accepting Applications for Class 3 Wholesale Class 4 Distribution and Class 6 Delivery Businesses on September 27

Author: Emerge attorney Brittany Tovar Three new cannabis license classes—wholesaler, distributor, and delivery—are opening for applications later this month in…

-

New Jersey’s Recreational Cannabis Industry – A Quick Guide to the Different License Types

The New Jersey CREAMM Act established six (6) classes of licenses for businesses that want to participate in the adult-use…

-

PsychedeLinks – September 15, 2023

Emerge’s Hot Take Other Noteworthy News

-

CannaBeat – September 11, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

After Years of Debate – California Bill to Legalize Psychedelics is Heading to the Governor’s Desk

Author: Delia Rojas, Attorney In a landmark legislative move, the California State Senate granted final approval for Senate Bill 58,…

-

Marijuana Rescheduling: The Good, the Bad, and the ‘Wait-and-See’

Author: Leticia Maskell, Emerge Law Clerk News broke last week that U.S. Health and Human Services (HHS) sent a letter…

-

PsychedeLinks – September 1, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

CannaBeat – August 25, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – August 18, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

Federal Trade Commission’s Proposed Rule on Deceptive Reviews

Authors: Jay Purcell, Shareholder; Kaci Hohmann, Attorney; Blake Marvis, Attorney; Leticia Maskell, Law Clerk Summary. On July 31, 2023, the…

-

CannaBeat – August 11, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

OLCC Update – New (and Resurgent) Cannabis Application Requirements

Author: Alex Berger, Attorney at Emerge Law Group On the heels of the new retailer tax compliance certificate requirement, OLCC…

-

PsychedeLinks – August 4, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

LISTEN: Emerge’s Matt Brockmeier Makes a Guest Appearance on the Roots to Risk Podcast by Alpharoot

From Education to Legislation: Unlocking the Potential of Psychedelics in Society via Alpharoot – Episode #15 – July 26, 2023 “In…

-

CannaBeat – August 1, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

What’s New in NY Cannabis: Five Key Updates

Written By: Leticia Maskell, Emerge Summer Clerk On July 19 the New York State Cannabis Control Board held its monthly…

-

Emerge Law Group Announces 2023 Oregon Super Lawyers & Rising Stars

We are pleased to announce that four attorneys at Emerge Law Group have once again been recognized as Oregon Super…

-

PsychedeLinks – July 21, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – July 18, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – July 7, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

CannaBeat – June 30, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

Oregon Psilocybin – Should Potency Regulations Extend Beyond Psilocybin Analyte?

Psilocybin mushrooms contain both psilocin and psilocybin. Psilocin is the active compound that induces mind-altering effects. Psilocybin (“psilocybin analyte” under…

-

PsychedeLinks – June 23, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

EMERGE HEADS TO THE ROCKIES!

Denver, CO • Portland, OR – Emerge Law Group (“Emerge”), a leading full-service law firm specializing in cannabis and psychedelics…

-

CannaBeat – June 16, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

OLCC Passes Cannabis Retailer Tax Compliance Rule and FAQ, Similar Rule for Other License Types Likely

Author: Alex Berger, Attorney at Emerge Law Group OLCC passed the cannabis retailer tax compliance rule today (June 15, 2023)…

-

More Details on OLCC’s Strict Retailer Tax Compliance Rule Set for Adoption This Thursday (June 15)

Author: Alex Berger, Attorney at Emerge Law Group Last week we published a blog post on OLCC’s anticipated marijuana retailer…

-

PsychedeLinks – June 9, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – June 7, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

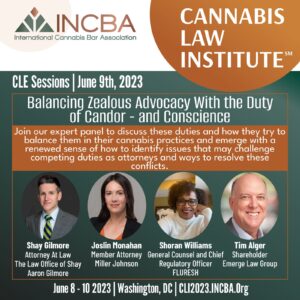

Emerge Shareholder Tim Alger to Speak at 2023 INCBA Cannabis Law Institute

Emerge shareholder Tim Alger is speaking at the 2023 INCBA Cannabis Law Institute at GW Law in Washington, DC.! This…

-

OLCC Set to Enact Strict Tax Compliance Rule for Cannabis Retailers This Month

Author: Alex Berger, Attorney at Emerge Law Group OLCC is set to enact a temporary emergency tax compliance rule for…

-

Exceptions to New York’s True Party Rule

Authors: Jay Purcell, Shareholder; Duncan Delano, Shareholder; Natalie Diaz, Law Clerk New York’s True Party rules are intricate and evolving.…

-

New York’s True Party Rule is Promiscuous

Authors: Jay Purcell, Shareholder; Duncan Delano, Shareholder; Natalie Diaz, Law Clerk Overview. Section 80 of the New York Marijuana Regulation…

-

PsychedeLinks – May 26, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

Redlining New York’s May 2023 Proposed Regs

Authors: Jay Purcell, Shareholder; Duncan Delano, Shareholder; Natalie Diaz, Law Clerk At a meeting on May 11, 2023, the New…

-

CannaBeat – May 19, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – May 12, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – May 10, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – May 1, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – April 24, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

Court v. Arbitration: Why You May Want to Rethink Putting a Mandatory Arbitration Clause in Your Contracts

Author: Blake Marvis, Emerge Litigation Attorney Rarely do litigators these days come across a contract that does not contain an…

-

A Brave New World: Oregon’s Legal Psilocybin Landscape

Authors: Dave Kopilak and Kaci Hohmann This article first appeared in the Oregon State Bar Business Law Section Newsletter •…

-

PsychedeLinks – April 14, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – April 7, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – March 31, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

Copyright Office Guidance Regarding Artificial Intelligence

Author: Sean Clancy*, Shareholder Understanding copyright law in the age of artificial intelligence can be complex and confusing. And it…

-

CannaBeat – March 24, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

PsychedeLinks – March 17, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – March 10, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

DEA Takes a Rare Step Forward for Telehealth

Author: Matt Brockmeier, Emerge Of Counsel Attorney The Ryan Haight Online Pharmacy Consumer Protection Act of 2008 (the Act) amended…

-

PsychedeLinks – March 3, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – February 24, 2023

CannaBeat is a curated biweekly selection of top news stories impacting business, research, and culture in the cannabis industry, crafted…

-

Critical Terms for Intellectual Property License Agreements (Part 2)

Author: Sean Clancy An audit provision is a clause in an intellectual property license agreement that provides the right for…

-

PsychedeLinks – February 17, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – February 10, 2023

CannaBeat is a curated biweekly selection of top new stories impacting business, research, and culture in the cannabis industry, crafted…

-

Trademark applicants – beware spoofed calls that impersonate the USPTO

Scammers have recently started calling trademark customers and falsely claiming to be an employee with the United States Patent and…

-

PsychedeLinks – February 3, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

You’re Invited! Allay Consulting and Emerge Law Happy Hour – 2/16/23

Emerge Law Group invites you to attend our Cannabis & Psychedelic Industry happy hour co-hosted with Allay Consulting! REGISTER HERE Thursday,…

-

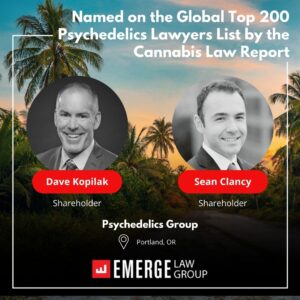

Emerge Attorneys Named on the Top 200 Global Psychedelic Lawyers and Policy & Regulatory Experts List

We are excited to share that two of our team members have been included in the Top 200 Global Psychedelic…

-

CannaBeat – January 27, 2023

CannaBeat is a curated biweekly selection of top new stories impacting business, research, and culture in the cannabis industry, crafted…

-

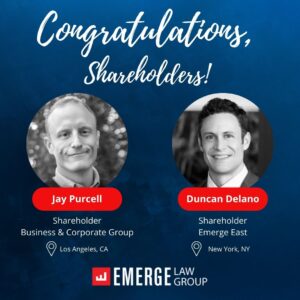

Emerge Law Group Announces New Shareholders

Emerge Law Group is pleased to announce that Jay Purcell and Duncan Delano have been promoted to shareholders at the…

-

Psychedelinks – January 20, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

CannaBeat – January 13, 2023

CannaBeat is a curated biweekly selection of top new stories impacting business, research, and culture in the cannabis industry, crafted…

-

Psychedelinks – January 6, 2023

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

CannaBeat – December 30, 2022

CannaBeat is a curated biweekly selection of top new stories impacting business, research, and culture in the cannabis industry, crafted…

-

Beneficial Owners – New Reporting Rules

Authors: Kaci Hohmann and Delia Rojas, Attorneys at Emerge Law Group On September 30, 2022, the federal Financial Crimes Enforcement…

-

Psychedelinks – December 23, 2022

PsychedeLinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by Emerge…

-

The CannaBeat Podcast – Copernican Solutions for Hemp & Cannabis

The CannaBeat Podcast – Copernican Solutions for Hemp & Cannabis Six years after Proposition 64, cannabis consultant Joanna Cedar explains why…

-

Residency Requirements Under Attack – Analysis of the First Circuit’s Opinion on the Dormant Commerce Clause’s Effect on Cannabis Residency Requirements

Author: Blake Marvis, Attorney at Emerge Law Group; Oregon Litigation Practice Group In August, the First Circuit Court of Appeals…

-

CannaBeat – December 16, 2022

CannaBeat is a curated biweekly selection of top new stories impacting business, research, and culture in the cannabis industry, crafted…

-

Psychedelinks – December 9, 2022

Psychedelinks is a curated selection of top news stories impacting business, research, and culture in the psychedelics ecosystem, crafted by…

-

Craft Beverage Industry Group (C-BIG): December Social at Backwoods Brewing

You are invited by the Craft Beverage Industry Group (C-BIG) to join us and our network of craft beverage business…

-

CannaBeat – November 23, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – November 18, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – November 16, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – November 11, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – November 9, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – November 4, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

New Guidance for Conditional Adult-Use Retail Dispensaries in New York

Authors: Duncan Delano, Attorney at Emerge Law Group Brittany Tovar, Law Clerk at Emerge Law Group On October 28, 2022,…

-

CannaBeat – November 2, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – October 28, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – October 26, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

The OLCC’s Latest Proposed Recreational Marijuana Rule Changes Could Significantly Impact Your Oregon Marijuana Business

Authors: Alex Berger, Attorney at Emerge Law Group Kristin Stankiewicz, Senior Counsel at Greenspoon Marder The Oregon Liquor and Cannabis…

-

CannaBeat Podcast: Increasing Access to California Cannabis

It’s estimated that 75% of cannabis transactions in California occur outside the regulated market. Dwell on that for a moment:…

-

Psychedelinks – October 21, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Next Deep Dive Webinar: Revised OHA Rules and Election Day Opt-Out Results

Two major events relating to the Oregon Psilocybin Services Act are right around the corner. First, the Oregon Health Authority…

-

CannaBeat – October 18, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – October 14, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – October 12, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

The Craft Beverage Industry Expands into to the Cannabis Space and Vice Versa

Author: Jake Cormier As the markets for legal cannabis continue to expand nationwide, companies continue to develop new products to…

-

The CannaBeat Podcast – Commercial Lending to Cannabis Businesses

The CannaBeat Podcast – Commercial Lending to Cannabis Businesses Is Alive w/ Robert Goebel of North Bay Credit Union North…

-

Craft Beverage Industry Group (C-BIG): Fall Social at Oakshire Beer Hall

You are invited by the Craft Beverage Industry Group (C-BIG) to join us and our network of craft beverage business…

-

Psychedelinks – October 7, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

President Biden Pardons Those Convicted of Federal Marijuana Possession

President Biden Pardons Those Convicted of Federal Marijuana Possession; Seeks Review of Marijuana’s Schedule I Status Yesterday President Biden pardoned…

-

CannaBeat – October 5, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

The CannaBeat Podcast – Lucas Seymour ~ Old Kai Distribution

The CannaBeat Podcast – Lucas Seymour of Old Kai Distribution Before Proposition 64 created the commercial adult-use cannabis industry…

-

Psychedelinks – September 30, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – September 28, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – September 23, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – September 21, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Oregon Psilocybin Services Act (Measure 109) Local Jurisdiction Tracker

If you follow Psychedelic Alpha, you might have noticed that Emerge Law Group has been working diligently to produce and…

-

Psychedelinks – September 16, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – September 14, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Introducing the “CannaBeat Podcast”

Introducing The CannaBeat Podcast We’re approaching two anniversaries: the 6-year anniversary of Proposition 64, the California voter initiative that legalized both…

-

Psychedelinks – September 9, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – September 7, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

The OHA’s Rules Are Out! Next Deep Dive Webinar Scheduled.

On September 1, 2022, the Oregon Health Authority released the second installment of draft rules implementing the Oregon Psilocybin Services…

-

CannaBeat – August 31, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – August 26, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – August 24, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – August 19, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Breaking: New York’s First Retail Cannabis Licenses Coming Soon

By: Duncan Delano and Brittany Tovar Applications for Conditional Adult-Use Retail Dispensary Licenses to Open Next Week The New York…

-

CannaBeat – August 17, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Special Announcement Regarding Emerge Law Group’s Next Deep Dive Webinar

Our Psychedelics Industry Group has been holding “Deep Dive” webinars on the last Thursday of each month. However, we have…

-

Dave Kopilak’s Rule Recommendations to the Oregon Heath Authority Regarding IRC Section 280E Issues

The next installment of the Oregon Health Authority’s (“OHA”) draft rules implementing the Oregon Psilocybin Services Act will be published…

-

Psychedelinks – August 12, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – August 10, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – August 5, 2022

PsychedeLinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

CannaBeat – August 2, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – July 29, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Critical Terms for Intellectual Property License Agreements (Part 1)

By: Sean Clancy Intellectual property (“IP”) license agreements come in many shapes and flavors. But all IP licenses boil down…

-

CannaBeat – July 26, 2022

CannaBeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Craft Beverage Industry Group (C-BIG): Summer Social at Backwoods Brewing Company

You are invited by the Craft Beverage Industry Group (C-BIG), to join us and our network of craft beverage business…

-

Psychedelinks – July 25, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – July 20, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – July 20, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: Mid-Year Update (Session 7)

Emerge Law Group is continuing its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session 7: Measure…

-

Local Governments Get a Second Bite at the Apple (or, in this case, Mushroom)

by: Corinne Celko In 2020 Oregon became the first state to legalize psilocybin, a psychoactive compound found in certain mushrooms. …

-

Oregon Beer Franchise Law

By Russell Rotondi, Shareholder One of the most important relationships a beer supplier or brewery will enter into is with…

-

Cannabeat – June 20, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – June 17, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Empire State of Cannabis Licensing: An overview of New York’s first adult-use cannabis licenses

New York’s Seeding Opportunity Initiative This spring, Governor Hochul and the NY Office of Cannabis Management (“OCM”) began to roll…

-

Task Force Meets to Discuss the Future of Oregon Cannabis Regulation

Last month a new Oregon task force charged with considering several cannabis-related issues held its first meeting. The task force,…

-

Cannabeat – June 6, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – June 4, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – May 31, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

California Cannabis Legislative Update

Governor Newsome Budget Proposal On May 13, 2022, Governor Newsom released his proposed California Budget which included cannabis tax reform. The…

-

Psychedelinks – May 27, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – May 23, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – May 20, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: Federal Law Issues (Session 5)

Emerge Law Group is continuing its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session 5: Federal…

-

Cannabeat – May 15, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – May 14, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – May 8, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – May 7, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – May 1, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – April 30, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Oregon Land Use: The Meanings of Words Matter (and so do dictionaries)

With so many ambiguous and seemingly indecipherable laws, rules, and regulations on the books, how are we supposed to know…

-

Limited Liability Company Equity Compensation for Employees

Like corporations, limited liability companies (“LLCs”) often incentivize employees with equity awards. Lots of companies and employees are familiar with…

-

Public Comment to OHA’s Psilocybin Training Curriculum Rules

See Dave Kopilak’s public comment to the proposed rules published by the Oregon Health Authority: https://emergelawgroup.com/wp-content/uploads/2022/04/LT-Oregon-Health-Authority-re-Public-Comments-on-Rules.pdf In his comment, Dave makes…

-

Cannabeat – April 24, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – April 23, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: Entity Organizations and Taxes (Session 4)

Emerge Law Group is continuing its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session 4: Entity…

-

Cannabeat – April 17, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – April 16, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – April 10, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – April 9, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Oregon Psilocybin Services Act: It’s Non-Medical, But Not Anti-Medical

There seems to be a fair amount of confusion out there as to whether the Oregon Psilocybin Services Act (the…

-

Craft Beverage Industry Group (C-BIG) 7-Year Anniversary Re-Launch at Gigantic Brewing

You are invited by the Craft Beverage Industry Group (C-BIG), to join us and our ever-growing network of craft beverage…

-

Efforts to Open Access to Psilocybin for Therapeutic Use with Those with Life Threatening Illness Continue

Emerge Law Group Special Counsel Kathryn Tucker submitted a Freedom of Information Act (“FOIA“) request to the Drug Enforcement Administration…

-

Cannabeat – April 3, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – April 2, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Lions and Tigers and Shell Companies, Oh My! Preparing Your Business for Federal Beneficial Ownership Reporting Requirements

By: Delia Rojas and Kaci Hohmann The Corporate Transparency Act (“CTA”), part of the federal Anti-Money Laundering Act of 2020,…

-

Welcome Jay Purcell

Emerge is pleased to welcome Jay Purcell, an experienced business attorney, bringing a wealth of experience and knowledge to the…

-

Cannabeat – March 27, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – March 26, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – March 20, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – March 19, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: Land Use and Local Jurisdictions (Session 3)

Emerge Law Group is continuing its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session 3: Land…

-

Cannabeat – March 13, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – March 12, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – March 6, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – March 5, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Oregon Legislature Passes OLCC License Moratorium Bill

The Oregon Senate voted to pass HB 4016 today completing the passage of the bill through both legislative houses. The…

-

Cannabeat – February 27, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – February 26, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Cannabeat – February 20, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – February 19, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s groundbreaking Psychedelics…

-

Potential Changes to Oregon Cannabis Testing: OHA Proposes Additional Marijuana and Hemp Testing

The Oregon Health Authority (OHA) has published proposed rule amendments that would subject certain marijuana and hemp items to additional…

-

Cannabeat – February 13, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – February 12, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law…

-

Establishing a Pathway to Access Psilocybin for Use with Patients with Advanced Illness: UPDATE

As counsel to Dr. Sunil Aggarwal of the Advanced Integrative Medical Science (“AIMS”) Institute we have been seeking authorization for…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: OHA Draft Rules #1 (Session 2)

Emerge Law Group is excited to continue its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session…

-

New Federal Trademark Proceedings: What To Know

On December 18, 2021, rules promulgated under the Trademark Modernization Act of 2020 (“Act”) went into effect. The rules, among…

-

Cannabeat by Emerge Law Group – February 6, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – February 5, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s…

-

The Potential Expansion of OLCC Marijuana License Moratoria: A Look at House Bill 4016

A bill – HB4016 – was recently introduced in the Oregon Legislature’s 2022 short session, which, if passed with one or…

-

Landmark Petition to Reschedule Psilocybin filed with DEA

Bipartisan Congressional support for allowing terminal patients to seek relief from anxiety and depression in alignment with ongoing international research on…

-

Connecticut Adult-Use Cannabis License Lotteries Start this Month

Connecticut’s adult-use cannabis license lotteries kick off in in a few days – here’s what you need to know. Under…

-

Ninth Circuit ducks merits in nation’s first legal challenge to allow access to psilocybin in end-of-life care under “Right-To-Try” laws

Bipartisan Congressional support for allowing terminal patients to seek relief from anxiety and depression in alignment with ongoing international research…

-

Cannabeat – January 30, 2022

Cannabeat is a weekly digest of news, business, and culture in the cannabis industry curated by members of Emerge Law…

-

Psychedelinks – January 29, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s…

-

Event Recording: Deep Dive Into The Oregon Psilocybin Services Act – Microdosing (Session 1)

Deep Dive Into the Oregon Psilocybin Services Act is a monthly virtual event series hosted by Emerge Law Group’s Psychedelics…

-

Microdosing Under the Oregon Psilocybin Services Act: A Definite Maybe

The issue of whether microdosing will be permissible under the Oregon Psilocybin Services Act has been a relatively hot topic…

-

Psychedelinks – January 22, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s…

-

FREE Virtual Event Series – Deep Dive Into the Oregon Psilocybin Services Act: Microdosing (Session 1)

Emerge Law Group is excited to launch its FREE virtual event series “Deep Dive Into the Oregon Psilocybin Services Act“! Session…

-

Starting the New Year in California Cannabis

There hasn’t been a dull moment in the California cannabis industry since the passage of Proposition 64, and rolling into…

-

Psychedelinks – January 8, 2022

Psychedelinks is a weekly digest of news, business, and culture in the psychedelics industry curated by members of Emerge Law Group’s…

-

Emerge Law Group Names Corinne Celko Managing Shareholder

Emerge Law Group announces Corinne Celko as the firm’s managing shareholder. Corinne is the first woman to lead Emerge and one…

-

Emerge Promotes Sean Clancy to Shareholder

Portland, OR – Emerge Law Group is pleased to announce that Sean Clancy has been promoted to shareholder at the…

-

Genny Kiley Speaks at NCIA’s 7th Annual Cannabis Business Summit

On December 16, 2021, shareholder Genny Kiley moderated the Legacy to Craft: Social Equity, Appellations, and Interstate Commerce panel at…

-

Emerge to Launch “Deep Dive into Measure 109” Virtual Event Series

Emerge Law Group is announcing the launch of a monthly virtual event series that will take an in-depth look at…

-

Emerge East: Pioneer Law Firm Goes Big to the Big Apple

Newark, NJ • New York, NY • Portland, OR – Emerge Law Group (“Emerge”), Oregon’s first full-service law firm with…

-

Why I Do What I Do: Representing patients with advanced illness

I represent Erinn Baldeschwiler in AIMS et al v DEA. Erinn is faced with advanced cancer, and the prospect of…

-

New York’s “Dream Team” Cannabis Control Board Holds First Public Meeting

New York State’s newly completed Cannabis Control Board (“CCB”) had its first public meeting Tuesday, pledging to move forward in…

-

Psilocybin Therapy for Patients with Advanced Illness in Oregon

One of the known beneficial uses of psilocybin is as a palliative care tool for patients with advanced illness who…

-

California’s Department Of Cannabis Control Consolidated Regulations APPROVED

In July of this year, the state consolidated the three separate cannabis regulatory agencies into one – Department of Cannabis…

-

Oregon Psilocybin Services Act: September 2021 Update

On September 25, 2021, Tom Eckert and I spoke about the Oregon Psilocybin Services Act at a seminar sponsored by…

-

New York Fills 2nd and 3rd Seats on 5-Member Cannabis Control Board

Governor Kathy Hochul kicked things off last Wednesday, appointing former Assemblywoman Tremaine Wright to chair the Cannabis Control Board (“CCB”)…

-

Court Hears Argument in Landmark Case Seeking to Open Access to Psilocybin Therapy

Nation’s First Legal Challenge to Allow Psilocybin Therapy in End-of-Life Care Under “Right-To-Try” Law Heard by the Ninth Circuit Court…

-

Federal Trademarks for CBD: “No CBD2GO” Says Trademark Trial and Appeal Board

The recent case of In re Blue Water Wellness, LLC (Serial No. 87893655) presents a useful summary of the legal…

-

New Jersey’s Cannabis Regulatory Commission Releases its Initial Rules for the Opening of the State’s Adult-use Cannabis Market.

Although this Zoom screenshot may look like just another boring government agency meeting, it was an exciting day in the…

-

Emerge Law Group Challenges Sonoma County, California Policy of Fining Medical Cannabis Users as Illicit Commercial Growers

Sonoma County, CA, August 16, 2021 — Emerge Law Group has filed a Petition in California Superior Court challenging penalties…

-

Emerge Law Group Expands with Addition of Three New Attorneys to Portland Office

Portland, OR – Emerge Law Group (“Emerge”) a full-service business law firm well known for its leading cannabis and psychedelics practices, announced…

-

Petitioners’ Reply Brief Filed, Briefing Now Complete in AIMS et al v DEA

On Friday, 7/23, Petitioners filed their Reply Brief with the Ninth Circuit Court of Appeals in AIMS et al v…

-

From Three to One: California Consolidation

On July 12, 2021 Governor Gavin Newsom signed the Cannabis Trailer Bill, Assembly Bill – 141, which, among other things, consolidates…

-

Two Emerge Attorneys Named Oregon Super Lawyers in 2021

We are excited to share that the 2021 Oregon Super Lawyers list has honored two of Emerge’s Oregon-based attorneys. Super…

-

Amici Curiae Supporting Case Seeking to Compel DEA to Allow Access to Psilocybin Therapy for Seriously Ill Patients

A Seattle palliative care physician, co-director of an integrative oncology clinic, and a number of his patients with advanced cancer…

-

Opening Access to Psilocybin Therapy for Seriously Ill Patients: The Petitioners’ Opening Brief in AIMS et al v DEA

Emerge Law Group is proud to represent a Seattle palliative care physician and co-director of an integrative oncology clinic, and…

-

Avenues to Access Psilocybin Therapy in Oregon, a New Palliative Care Tool for Patients Suffering Anxiety and Depression

By Kathryn L. Tucker, JD* Recent medical research is establishing the powerful therapeutic uses of psilocybin in the treatment of…

-

Oregon Psilocybin Advisory Board Meeting #1

The first meeting of the Oregon Psilocybin Advisory Board (the “Board”) created by Oregon Measure 109 (“M109”) was held on…

-

First Meeting of Oregon Psilocybin Advisory Board is Today

The first meeting of the Oregon Psilocybin Advisory Board created by Oregon Measure 109 will take place today, March 31,…

-

Oregon Psilocybin Advisory Board Is Announced!

Governor Kate Brown has announced the members of the Oregon Psilocybin Advisory Board (the “Board”) created by Oregon Measure 109. …

-

Nation’s First Legal Challenge to Allow Psilocybin Therapy in End-of-Life Care Under “Right-To-Try” Laws Moves Forward

On behalf of terminally ill patients suffering anxiety and depression, we announce an advocacy effort to open access to psilocybin…

-

Oregon Cannabis: Key OLCC Rule Amendments Open for Public Comment

Last week the Oregon Liquor Control Commission (“OLCC”) published two proposed rule amendment packages – the “Marijuana Licensing Streamlining” and…

-

California Cannabis: Billboard Advertising

On January 21, 2021, the California Bureau of Cannabis Control (“BCC”) issued a notification that on January 11th the Superior…

-

Cooperative Federalism Returns with the Biden Administration: Implications for Cannabis as well as Psilocbyin

In November 2020, Oregon voters approved a first of its kind initiative to make psilocybin therapy legal under Oregon state…

-

Emerge Recognized as 8th Most Diverse Small Law Firm in Oregon

Emerge is pleased to be recognized by the Portland Business Journal as the 8th most diverse small law firm (20 or less…

-

Opening access to psilocybin therapy for those with life-threatening illnesses

Multiple recently conducted clinical trials show that therapy with psilocybin for relief of anxiety and depression in patients with advanced…

-

Open for Opportunity: 2021 Changes for the California Cannabis Industry

To say the least, 2020 was a year unlike any other, including for the cannabis industry. California, among other states,…

-

Emerge Expansion Continues with Two New Attorneys in California!

Emerge is proud to announce its further expansion in California with the addition of two attorneys, Timothy Alger and Delia…

-

California: New Year, Potential New Extension

On December 7, 2020, a Senate Bill 59 was introduced in the California State Assembly that would extend the expiration…

-

Remembering Sheri Eckert

All of us at Emerge Law Group are deeply saddened to learn about the untimely death of Sheri Eckert, co-sponsor…

-

As More States Embrace Cannabis, One Oregon County Rejects It. Again.

States across the country have embraced cannabis law reform. The 2020 election brought the total number of states to legalize…

-

Client of Emerge Law Group Seeks State and Federal Permission to Grow Psilocybe Mushrooms to Provide Psilocybin Therapy

First of its Kind Advocacy Effort to Open Access to Psilocybin for Terminally Ill Patients Emerge Law Group is representing…

-

Legalizing Psilocybin-Assisted Therapy: Insider tips from the Oregon campaign

Dave Kopilak, primary drafter of Oregon Measure 109, and campaign manager Sam Chapman, were interviewed by New York psychedelics law…

-

Oregon Measure 109 Passes!!!

Emerge Law Group celebrates the passage of Oregon Measure 109, also known as the Oregon Psilocybin Services Act (“M109”). M109,…

-

HB 4213: Notices of Nonpayment for Commercial Landlords and Tenants

In response to the COVID-19 pandemic, the Oregon Legislature passed House Bill 4213 on June 26, 2020, which extended the…

-

Oregon Marijuana Regulatory Roundup

The Oregon Liquor Control Commission (“OLCC”) has been busy over the last couple months working on new rule and policy…

-

Five Key Steps When Selling Your Business: From Preparation to Purchase Agreement

Sales of most small companies involve a fairly standard and predictable process that can be followed when selling your business. …

-

Oregon Psilocybin Services Act: Measure 109’S Regulatory and Licensing Structure

This blog is the second in a series of substantive explanations of Oregon Measure 109 that we will publish before…

-

Oregon Psilocybin Services Act: Measure 109’s Two-Year Development Period

The initiative petition formerly known as Oregon Initiative Petition 2020-034 has been rebranded as Oregon Measure 109. And with seven…

-

Emerge Expands its Psychedelics Practice Group

Emerge Law Group is pleased to announce that Kathryn L. Tucker is joining our firm as Special Counsel, to co-lead…

-

Oregon Psilocybin Services Act (IP 34) Qualifies for the November Ballot

On July 8, 2020, Oregon Initiative Petition 2020-034 (“IP 34”) officially qualified for the November 3, 2020 General Election ballot.…

-

Follow-up: Guide to Accessing Paycheck Protection Program for Small Businesses Affected by COVID-19

On April 24, 2020, President Trump signed the new “phase 3.5” emergency coronavirus relief package into law (the “Bill”). The…

-

Guide to Accessing Paycheck Protection Program for Small Businesses Affected by COVID-19

The federal Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) was signed into law on March 27, 2020…

-

Contracts During Coronavirus

By Sean Clancy and Kaci Hohmann As the coronavirus (COVID-19) pandemic rips across the planet, relationships between the environment, governments,…

-

Our Current Overview of State and Local Responses to EVALI to Date

Late 2019 saw a national outbreak in hospitalized cases of e-cigarette or vaping product use associated lung injury (EVALI). The…

-

Key OLCC Amendments Going Into Effect on February 1, 2020

The Oregon Liquor Control Commission (“OLCC”) recently published several amendments to its regulations that will go into effect on February…

-

Oregon’s New Corporate Activity Tax and Its Impacts on Businesses

In the legal field, the beginning of a new year is often synonymous with new laws and 2020 is no…

-

Writing Requirements for Copyright Transfers

By default, the author of an original work of creative authorship owns the copyright to that work upon creation. And…

-

Your Chance to Provide Input to OLCC on Proposed Rule Amendments

On November 1, 2019, the Oregon Liquor Control Commission (“OLCC”) released proposed amendments to the recreational marijuana rules and the…

-

OLCC Temporary Rules Regarding Vape Products

On October 11, 2019, the Oregon Liquor Control Commission (“OLCC”) commissioners voted unanimously to adopt temporary rules implementing Governor Brown’s…

-

What the New Deschutes County Ban on OLCC Processors and Producers Means for You

On August 19th, 2019, the Deschutes County Board of Commissioners voted unanimously to opt out of the establishment of “future…

-

A Word on the New Nationwide “Vaping Illness”

There’s a lot of fear out there, but not a lot of information regarding the safety of e-cigarettes and cannabis…

-

The Criminal Hemp Processing Case that Could Have a Profound Effect on the Oregon Hemp Industry

There’s a battle brewing in Oregon state court that may have a serious impact on Oregon’s industrial hemp industry. We’re…

-

Clearing Up the SB 218 (Application Caps) Confusion

On Monday, June 17, Governor Kate Brown signed Senate Bill 218 (“SB 218”) into law. See our earlier blog post…

-

Employers, Pay Attention to These Changes in the Law!

With the Oregon Legislature wrapping up the 2019 session, it’s a good time to look at some of the upcoming…

-

Business Law: Amending LLC and Partnership Agreements to Protect Against the New IRS Audit Rules

For those of you with business partnerships (including LLCs taxed as partnerships) filing an IRS Form 1065 U.S. Return of…

-

Signing on the Dotted Line: Contract Signature Issues in Litigation

The idea that “any contract is better than no contract” gets many new businesses into hot water. Small businesses, start-ups,…

-

USPTO Issues New Guidance for Cannabis-Related Trademark Applications

On May 2, 2019 the United States Patent and Trademark Office (USPTO) issued new guidance regarding cannabis-related trademark applications following…

-

Coming to Terms with the Economic Impact of the Harborside Case

Opinions released by the U.S. Tax Court in two important cases late last year have substantially changed the economic landscape…

-

Legislative Spotlight: What is the Deal with Capping Licenses???

Unless you’ve been living under Haystack Rock for the last year and a half, if you’re in the cannabis business…

-

Emerge Recognized as 3rd Most Diverse Small Law Firm in Oregon

Emerge is pleased to be recognized by the Portland Business Journal as the 3rd most diverse small law firm (20 or less attorneys)…

-

New Year, New Rules: ODA Industrial Hemp Edition

Hello Friends. Following the passage of the 2018 Farm Bill (see previous hemp posts Breaking News: Congress Passes 2018 Farm…

-

Happy New Year and New Rules!: OLCC Edition

January is a time for reflecting on the past year, resolutions for the new year, and overpriced outdoorsy puffy coats. …

-

FDA Comes out of the Shadows on CBD

Happy New Year from Emerge! Beyond the usual holiday food, friends, family, and commerce, this has also been a unique…

-

Breaking News – Congress Passes 2018 Farm Bill!

The US House of Representatives overwhelmingly passed the much anticipated 2018 Farm Bill, which now awaits (this is still so…

-

Cannabis Law Firms Merge, Bridging the West Coast

Emerge Law Group (“Emerge”), Oregon’s first full-service, boutique law firm specializing in the legal cannabis industry has merged with industry…

-

Canna-Banking Post Sessions Memo

Bankers are primarily risk managers, so to understand what happens to canna-banking after Attorney General Jeff Sessions rescinded all Obama-era…

-

What the Sessions Memo Means for California

Yesterday morning, Attorney General Jeff Sessions issued a memorandum upending existing federal policy regarding enforcement against states with legalized cannabis.…

-

The Sessions Memo

The Cole Memo is history. The Sessions Memo, which was released today, January 4, 2018, is now the policy of…

-

California Releases Draft Medicinal and Adult-Use Regulations

California Releases Draft Medicinal and Adult-Use Regulations On Thursday, November 16, the three (3) California cannabis-licensing agencies released draft emergency…

-

Oregon Legislative Update (Part 3): What You Need To Know About SB 1015

On June 29, 2017, Governor Brown signed a bill impacting Oregon’s hemp industry into law. SB 1015, which goes into…

-

Oregon Legislative Update (Part 2): What you need to know about HB 2198

Just days before the end of the 2017 session, the Oregon legislature passed a major cannabis-related bill. Surviving a relatively…

-

Oregon Legislative Update (Part 1): What you need to know about SB 1057

The Oregon Legislative Assembly adjourned on Friday, July 7, 2017. As the dust from this session settles, the State of…

-

Oregon Governor Brown Signs SB 56

Today, Oregon Governor Kate Brown signed SB 56 into law. This law is effective immediately and contains several anticipated fixes…

-

Oregon SB 56 Passes: Key Changes to OMMP and OLCC Laws

Today, the Oregon legislature passed Senate Bill (SB) 56, which contains several of the anticipated “fixes” to the cannabis regulatory…

-

Oregon’s Minimum Wage Changes on July 1, 2017

Effective July 1, 2017, Oregon’s minimum wage increases across the State. As you may recall, in 2016, Oregon adopted a…

-

California: Legislature Passes Trailer Bill, Reconciling Medicinal and Adult-Use Laws

Yesterday, the California legislature passed Senate Bill 94, known as the “2017-18 Budget Trailer Bill” (BTB). The BTB reconciles the…

-

Oregon: The Latest on Applicants and Financial Interests

I’m just an old corporate attorney. At the large firm I worked at for nearly 20 years, “dabbling” into practice…

-

The Donald Trump Risk Factor and a Showdown for the Cole Memo

Bad dreamer, what’s your name? Looks like we’re riding on the same train Looks as though there’ll be more pain…

-

Update Alert: Judge Blocks Minimum Salary Changes for Exempt Employees

Major changes to the minimum salary requirements for exempt employees originally scheduled to take effect on December 1, 2016, are…

-

Election 2016: Cannabis Legalization Results

Yesterday’s election was historic in many ways. The imminent change in federal administration may have repercussions for state-run legal marijuana…

-

Reminder: Big Changes to Minimum Salary for Exempt Employees Coming December 1

On December 1, 2016, big changes are coming to the minimum salary requirements for exempt employees. The U.S. Department of…

-

OLCC Releases Order Pertaining to New Pesticide Testing Rule

On September 30, we blogged about the OLCC and OHA’s emergency rulemaking in the face of the October 1 labeling,…

-

October 1 Update: Very Limited Relief

Unfortunately the hope that the October 1, 2016 deadlines would be pushed back did not occur. The Oregon Health Authority…

-

October 1: Temporary Emergency Rulemaking

The Oregon Health Authority (OHA) has announced that it will engage in temporary emergency rulemaking this week to address two…

-

Emerge Law Group Announces Employment Law Class for Cannabis Employers

Emerge Law Group is excited to offer the free Employment Law Compliance for Cannabis Employers class on September 28, 2016…

-

October 1: Five Tips for Oregon Dispensaries

There are significant changes to the Oregon Medical Marijuana Program that will take effect on October 1, 2016. In recent blogs…

-

October 1: How will Oregon medical marijuana processors be affected?

On and after October 1, 2016, ALL medical marijuana processors must be registered with the Oregon Health Authority (OHA) in…

-

Oregon’s Special Packaging and Labeling Rules for Small Containers

Many people have been asking about what to do if their container is too small to fit all of the…

-

Oregon’s Marijuana Packaging Rules

If you are an Oregon marijuana business owner, you will need to ensure compliance with not only new labeling rules, but…

-

Oregon’s Marijuana Labeling Rules

Whether you are involved in the medical or recreational side of the Oregon cannabis industry, you will likely be required…

-

OMMP Reporting: Do your best

As many of you know, the Oregon Medical Marijuana Program (OMMP) requires reporting to track medical marijuana transfers. All registered…

-

Oregon DOJ Clarifies Medical and Homegrow Plants Allowed

We get this question a lot. Can I have six mature medical plants and four home grow plants? The answer is…

-

Independent Contractor or Employee: Why you need to get it right! (Part 2)

Part 2: The High VERY HIGH Cost of Misclassifying an Employee as an Independent Contractor. Misclassifying an employee as an…

-

Independent Contractor or Employee: Why you need to get it right! (Part 1)

Part 1: Independent Contractor or Employee? You might think determining whether a worker should be treated as an independent contractor…

-

Oregon Marijuana Extracts and Edibles Update (Part 2)

On March 18, 2016, the Oregon Health Authority (OHA) released Information Bulletin 2016-05 announcing that the unregistered manufacture of cannabinoid…

-

Oregon Plant Limits: What is a stay?

How many mature marijuana plants can I grow/posses? That is a question we get a lot from Oregon growers. The…

-

Oregon Marijuana Extracts and Edibles Update (Part 1)

The Oregon Health Authority (OHA) released Information Bulletin 2016-05 in an attempt to clarify many questions surrounding the legality of marijuana extraction…

-

Emerge Wins Inaugural Dope Industry Award for Best Law Firm in Oregon

Emerge Law Group is honored to have been voted the Dope Industry Award for Best Law Firm in Oregon by…

-

Oregon’s 25% Sales Tax on Early Sales

* * * Updated January 21, 2016 * * * Oregon’s the new sales tax is applicable to medical dispensaries…

-

Public Service Announcement: City of Portland Marijuana Licenses

Public Service Announcement: All marijuana businesses located in the City of Portland must obtain a City Marijuana Regulatory License (“City…

-

Oregon Marijuana Laws: The Status of Residency Requirements After HB 3400 (Part 4)

In Part 3 of this series, I discussed the residency rules for Ballot Measure 91 businesses that the Oregon Liquor…

-

Oregon Marijuana Laws: The Status of Residency Requirements After HB 3400 (Part 3)

On August 14, the Oregon Liquor Control Commission (“OLCC”) distributed to members of the Rules Advisory Committee (“RAC”) a revised…

-

Organic Marijuana: Another Problem With Federal Law

Is there such a thing as organic marijuana? Like most things in the industry, the answer isn’t simple. Many cultivators…

-

Oregon Marijuana Laws: The Status of Residency Requirements After HB 3400 (Part 2)

On July 17, the Oregon Liquor Control Commission (“OLCC”) distributed to members of the Licensing, Compliance, and Enforcement Technical Advisory…

-

The Ninth Circuit Applies 280E

If a tax practitioner tells you the Tax Court cases of CHAMP and Olive are singularly unfavorable to cannabis businesses,…

-

Personal Agreements: OMMP grower and patient contracts

After the dust settles from a legislative session we are always left wondering what happened. Especially after this session which…

-

Oregon Marijuana Laws: The Status of Residency Requirements After HB 3400 (Part 1)

Ballot Measure 91 intentionally did not include any residency requirement for anyone who owned or who was otherwise involved with…

-

Are We There Yet: Ballot Measure 91 next steps

As we creep towards the finish line of the Oregon legislative session, the issues seem to be winding down. The…

-

Ballot Measure 91: Early sales and joint stores?

The questions I get most frequently (other than local government questions) are whether early sales to the adult use market…

-

Ballot Measure 91: Joint Committee stalemate

Last night the Joint Committee for the Implementation of Ballot Measure 91 locked down. After working for almost the entire…

-

Gresham Marijuana Dispensary: When a yes is really a no

The City of Gresham has been relatively opposed to allowing medical marijuana dispensaries to open within their limits. While located…

-

Clackamas Marijuana Dispensary Update

The Oregonian did a round-up of the Clackamas marijuana regulations pertaining to medical marijuana facilities now that May 1st has…

-

Welcome Marco Materazzi

Emerge Law Group is pleased to welcome Marco Materazzi, an experienced business lawyer with a practice focused on emerging growth…

-

Overhaul of WA Medical Marijuana Program

Last Friday, Washington Governor Jay Inslee signed into law Senate Bill 5052, also known as the Cannabis Patient Protection Act. …

-

OLCC and Ballot Measure 91: New revenue projections

According to the Portland Business Journal, the OLCC has put in their budget for Ballot Measure 91 for 2015- 2016.…

-

Marijuana and Indian Tribes: First steps forward

Indian reservations now have the opportunity to cultivate and sell cannabis if they so choose under authority granted to them…

-

Ballot Measure 91: Guide to July 2015

Beginning July 1, 2015, Ballot Measure 91 will allow Oregon residents 21 years and older to possess, grow, and transfer…

-

MBank to abandon cannabis industry banking

MBank announced today that it will close all of its accounts with marijuana businesses in the next few months. The…

-

Ballot Measure 91 and the OLCC: Who’s who in implementation

Before fully understanding the upcoming regulation schemes for recreational marijuana in Oregon, it is important to recognize the individuals responsible…

-

280E and Oregon Cannabis Business: What is a trade or business?

Section 280E – not so simple after all Despite what your eyes are telling you, “trade or business” is actually…

-

280E and Cost of Goods Sold: Can’t win for losing

Cost of Goods Sold. Deductible or not deductible? That is the 280E question. Section 280E of the Internal Revenue Code…

-

Ballot Measure 91 and Local Taxes: Extended version

“I tell ya I don’t get no respect. No respect at all.” If Sections 42 and 58 of Ballot…

-

Why Networking is Important For a Cannabis Business

Emerge Law Group is headed to Vegas today for the MMJ Business Daily Conference and the NCIA 4th anniversary dinner. We will…

-

How To Start a Cannabis Business in Oregon Post BM91

Now that Ballot Measure 91 has passed many people who have been waiting on the sidelines are feeling more comfortable…

-

280E and Your Business: An Oregon Cannabis Lawyer’s Perspective

Support for the ongoing planning process that is managing a business is a big part of why a marijuana business…

-

Oregon Ballot Measure 91, better than Washington I-502?

As we get closer to the November election and the potential (likely?) passage of Ballot Measure 91 in Oregon, the…

-

Before Oregon Ballot Measure 91: Judge rules bans ok

As we are getting closer to the election, we at Emerge are closely following Ballot Measure 91. Ballot Measure 91…

-

New Brand & Website

Emerge Law Group is pleased to announce the launch of our new brand & website! Throughout our site you will…